What you need to know about CEWS and how it can help your operations

As a Canadian employer that has been affected by COVID-19, the Canadian Emergency Wage Subsidy (CEWS) may enable you to re-hire or keep your workers, and put you in a better position to resume operations in the months to come. However, determining eligibility and understanding the nuances of the subsidy to avoid government penalties if your application is later deemed invalid, can create a high level of stress and uncertainty.

Join professionals from KPMG in Canada as they discuss the common issues and challenges of the subsidy program, along with guidance on recent legislative changes.

The webcast will cover:

- Employer and employee eligibility requirements;

- Recent significant amendments;

- Adjustments to the required revenue decline threshold;

- Considerations for adjustments to qualifying revenue;

- Paymaster issue;

- Maximizing claim potential for employees with retroactive recall;

- Reporting subsidy claims on employee’s 2020 T4s.

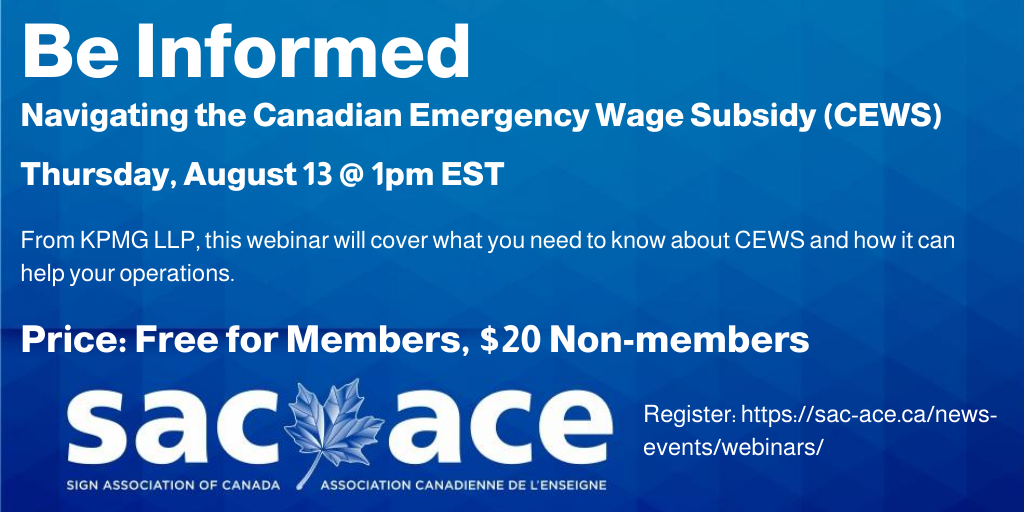

Featured Speaker: Barry Travers, Partner, National Tax, KPMG LLP

Session Details:

Date: Thursday, August 13, 2020

Time: 1:00pm – 2:00pm (EST)

1 Comment